What is Project Finance?

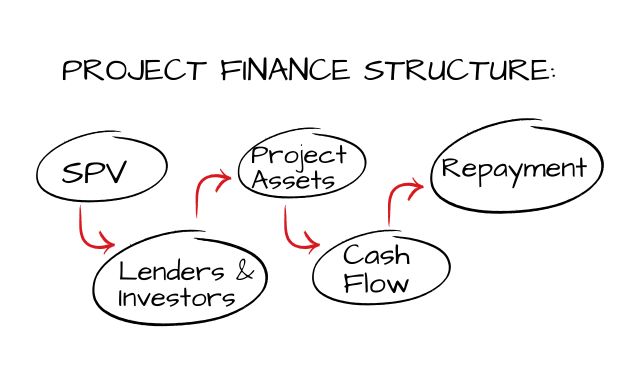

Project finance is a specialized financing method used for large-scale infrastructure, energy, and industrial projects. Unlike traditional corporate finance, it relies on the project’s future cash flow as collateral rather than the borrower’s balance sheet.

If the project fails, lenders can only recover their funds from the project itself—not from the sponsor’s balance sheet. 1, 2

For businesses looking to expand or entrepreneurs with big ideas, securing $100M+ in project financing can be the key to turning vision into reality. But how does it work? Who provides this type of financing? And what are the risks and rewards?

Project finance funds large-scale projects using the project’s cash flows and assets, structured via a Special Purpose Vehicle (SPV).

Enables major infrastructure, energy, and industrial projects while isolating risks from sponsors’ balance sheets.

Uses non-recourse or limited recourse financing, with repayment tied to project revenue.

Why Project Finance Matters

Project finance plays a critical role in:

- Enabling Large Infrastructure – Funds projects too big for single entities

- Risk Management – Isolates project risk from sponsors

- Economic Development – Facilitates public-private partnerships

- Innovation Financing – Supports new technologies (renewables, etc.)

Project finance vs. other financing methods

What’s the difference between project finance and corporate finance? In answer to this common question, project finance is non-recourse to sponsors and repaid solely from project cash flows, while corporate finance relies on the company’s overall credit.

| Project Finance | Corporate Finance | Equity Financing | |

| Collateral | Project assets & cash flow | Company balance sheet | None (ownership stake) |

| Risk | Limited to project | Shared with company | High for investors |

| Repayment | Project cash flow | Company revenue | Dividends or exit sale |

Key Features of Project Finance

- Non-Recourse or Limited Recourse – Lenders have limited claims beyond project assets.

- Special Purpose Vehicle (SPV) – The project is structured as an independent legal entity.

- Long-Term Financing – Typically spans 10-30 years, depending on the sector.

- Risk Distribution – Risks are shared among investors, lenders, and sponsors.

How Project Finance Works: A Step-by-Step Process

Project financing follows a distinct structured approach that differs from traditional corporate loans:4

Project Identification & Feasibility Study

- A sponsor (company, government, or entrepreneur) identifies a project opportunity with predictable cash flows.

- A feasibility study is conducted to evaluate costs, risks, and revenue potential.

- Financial models are created to forecast future cash flows.

Formation of the Special Purpose Vehicle (SPV) & Risk Allocation

- An SPV (Special Purpose Vehicle) is created as a separate legal entity.

- The SPV owns the project assets and signs contracts with stakeholders.

- This ensures that financial risks remain within the project itself. Risks are strategically distributed among parties through contractual agreements.

Financing Structure & Securing Funds ($100M+)

- Sponsors approach institutional investors, development banks, and private lenders.

- A financing structure is created, including equity investment and debt financing.

- Lenders assess risk before approving funds.

Construction & Operation Phase

- The project enters the construction phase, using the secured capital.

- Once completed, it begins generating revenue (e.g., tolls, energy sales, leases).

- Revenue is used to repay loans and generate returns for investors.

Debt Repayment & Exit Strategy

- Lenders are repaid through cash flow from operations.

- Investors exit through asset sales, IPOs, or long-term ownership.

Key Players in Project Finance

- Project Sponsors – Entrepreneurs, corporations, or governments launching the project.3

- Lenders – Banks, institutional investors, private equity firms.

- Equity Investors – Shareholders investing in the project for future returns.

- Government & Regulators – Providing approvals and policy support.

- Contractors & Operators – Responsible for construction and operation.

Industries That Use Project Finance

What types of projects use project finance?

Project finance is common in capital-intensive industries, Typically large infrastructure (power plants, toll roads), industrial projects (mines, factories), and public works, such as:

- Infrastructure – Roads, bridges, airports, railways.

- Energy & Utilities – Renewable energy, power plants, mining, oil and gas pipelines.

- Real Estate & Industrial Development – Large-scale commercial projects and construction industry.

- Transportation & Logistics – Ports, shipping terminals.

- Water & Sanitation – Desalination plants, wastewater treatment.

Advantages & Disadvantages of Project Finance

Benefits

- Large Capital Availability – Access to significant financing without over-leveraging the company’s balance sheet.

- Risk Isolation – Sponsors limit financial exposure by using an SPV.

- Long-Term Financing – Ideal for capital-intensive projects requiring extended repayment periods.

Risks & Challenges

- Complex Structuring – Requires thorough legal and financial planning.

- High Due Diligence Requirements – Extensive feasibility studies and risk assessments are necessary.

- Long Approval Timelines – Funding negotiations can take years.

How long does project financing take to arrange?

Typically it takes 6 to 18 months to arrange project finance due to complex structuring and due diligence.

Project Financing Methods

Projects can be financed through various structures:

- Limited Recourse Financing – Lenders have claims only on project assets

- Non-Recourse Financing – No claims on sponsor assets

- Mezzanine Financing – Hybrid debt/equity instruments

- Public-Private Partnerships (PPP) – Joint government/private sector funding

- BOT (Build-Operate-Transfer) – Private entity builds/operates then transfers to government

Real-world Examples of Project Finance

- Renewable Energy Project – A $500M solar farm financed through an SPV, with lenders relying on future energy sales for repayment.

- Infrastructure Development – A $1B toll road project funded by a consortium of banks, with revenue generated from toll collections.

Risk Mitigation Strategies

Project finance involves complex risks that require proactive management. Here’s how sponsors and lenders protect investments:

Construction Risk

Potential Issues: Delays, cost overruns, contractor failure

Mitigation:

- Fixed-price EPC contracts (Engineering, Procurement, Construction) with penalties for delays

- Completion guarantees from sponsors during construction

- Contingency reserves (typically 10–15% of budget). Contingency Planning allocates reserves for unexpected costs or delays.

Operational Risk

Potential Issues: Lower-than-expected output, maintenance failures

Mitigation:

- Long-term O&M agreements with experienced operators

- Performance bonds from contractors

- Reserve accounts for maintenance and repairs

Market/Demand Risk

Potential Issues: Revenue shortfalls due to weak demand or price shifts

Mitigation:

- Offtake agreements (e.g., power purchase agreements for 80–100% of output)

- Price hedging for commodities/currency fluctuations

- Demand studies from independent consultants

Political/Legal Risk

Potential Issues: Regulatory changes, expropriation, permits

Mitigation:

- Political risk insurance protects against government interference or policy changes (e.g., MIGA/World Bank coverage)

- Government guarantees for critical projects

- Stabilization clauses in contracts to freeze regulations

Financial Risk

Potential Issues: Interest rate hikes, inflation, liquidity crunches

Mitigation:

- Interest rate swaps/caps to manage volatility

- Debt service reserve accounts (6–12 months of coverage)

- Inflation-linked tariffs in revenue contracts

- Hedging – Mitigates currency and interest rate risks.

Risk Allocation Framework

| Risk Type | Typically Borne By | Tools Used |

|---|---|---|

| Construction | Contractors/Sponsors | EPC contracts, guarantees |

| Operational | Operators/Insurers | O&M agreements, performance bonds |

| Market | Offtakers/Sponsors | PPAs, hedging |

| Political | Governments/Insurers | Insurance, sovereign guarantees |

| Financial | Lenders/Sponsors | Reserve accounts, derivatives |

Pro Tip: The strongest projects allocate each risk to the party best able to control it (e.g., contractors handle construction risk, off-takers absorb market risk).5, 6

How to Secure Project Finance for a $100M+ Project

If you’re seeking project finance for a large-scale venture, follow these steps:

- Prepare a Strong Business Case – Show clear financial viability and ROI.

- Develop a Comprehensive Financial Model – Demonstrate cash flow potential.

- Build a Strong Team – Investors want experienced management.

- Find the Right Lenders & Investors – Target banks, funds, and development institutions specializing in large-scale financing.

- Negotiate Favorable Terms – Secure financing with manageable repayment structures.

Checklist for Project Owners

- Conduct a feasibility study.

- Create a detailed financial model.

- Establish an SPV.

- Identify and engage lenders/investors.

- Secure necessary approvals and permits.

- Develop a risk mitigation plan.

Common Pitfalls to Avoid

- Underestimating project costs.

- Failing to conduct thorough due diligence.

- Poor stakeholder engagement.

- Inadequate risk assessment and planning.

Final Thoughts: Is Project Finance Right for You?

If you’re developing a large-scale project with strong revenue potential but need $100M+ in funding, project finance may be the ideal solution. The key is structuring your project to attract investors and lenders while mitigating risks.

REFERENCES:

- Investopedia, Adam Hayes, Project Finance: Definition, How It Works, and Types of Loans, retrieved from https://www.investopedia.com/terms/s/spv.asp

- Investopedia, Adam Hayes, What Is a Special Purpose Vehicle (SPV) and Why Companies Form Them, retrieved from https://www.investopedia.com/terms/s/spv.asp

- Ori Schibi, Cheryl Lee, Project sponsorship, retrieved from https://www.pmi.org/learning/library/importance-of-project-sponsorship-9946

- WallStreetMojo, Financial Structure, retrieved from https://www.wallstreetmojo.com/financial-structure/

- Investopedia, James Chen, Due Diligence, retrieved from https://www.investopedia.com/terms/d/duediligence.asp

- Robert S. Kaplan, Anette Mikes, Managing Risks: A New Framework, retrieved from https://hbr.org/2012/06/managing-risks-a-new-framework